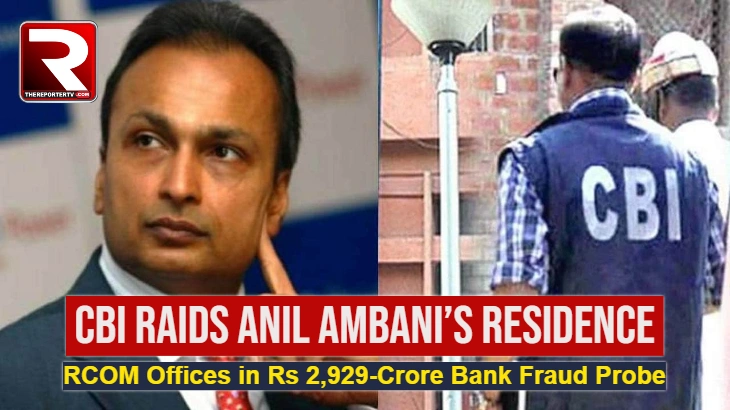

New Delhi : The Central Bureau of Investigation (CBI) on Saturday conducted searches at two locations in Mumbai, including the residence of industrialist Anil D. Ambani and the corporate premises of Reliance Communication Ltd. (RCOM), as part of its investigation into an alleged ₹2,929.05 crore bank fraud.

The searches were carried out following the registration of a case on August 21, 2025, based on a complaint filed by the State Bank of India (SBI), Mumbai. The complaint accuses RCOM, its Director Anil Ambani, unidentified public servants, and others of cheating the bank and causing significant financial losses.

According to CBI officials, the accused allegedly conspired to misrepresent financial information in order to secure credit facilities from SBI in favour of RCOM. Once obtained, the funds were reportedly misused and siphoned off through a network of inter-company transactions and corporate deposits.

The agency also flagged several financial irregularities, including the misuse of sales invoice financing, the discounting of RCOM bills by Reliance Infratel Ltd., and fund transfers through various group entities. A capital advance given to Netizen Engineering Pvt. Ltd.—another Reliance ADA Group firm—was allegedly written off without due process.

Moreover, investigators suspect that fictitious debtors were created and subsequently written off in the books to disguise the diversion of funds. The CBI has invoked charges of criminal conspiracy, cheating, and criminal breach of trust in the ongoing probe.

A special CBI court in Mumbai had issued search warrants on August 22, enabling Saturday’s raids. “The searches are still continuing,” the CBI said in an official statement.

This development comes just weeks after Anil Ambani was questioned for over nine hours at the Enforcement Directorate (ED) headquarters in New Delhi in connection with a separate ₹17,000-crore loan fraud case.

The ongoing investigation marks one of the largest bank fraud cases linked to a telecom firm in India, highlighting increasing regulatory scrutiny over corporate borrowing and financial disclosures in the sector.